Ubs client account software

Author: e | 2025-04-23

UBS Software System : UBS Software: Contact : About Us : Support : Download : UBS Accounting : UBS Inventory : UBS POS : UBS Payroll : UBS Client Account : UBS Building

Download UBS Client Account Software

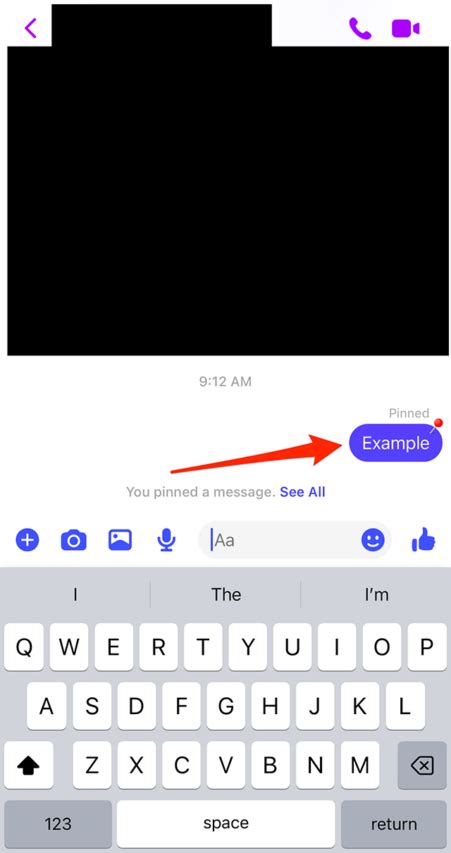

Do not reflect actual investment results, and are not guarantees of future results. Use of the UBS Wealth Management USA app and UBS Financial Services app are subject to terms and conditions. Other restrictions may also apply. Certain products, functionalities and services described herein or contained or otherwise made available via these apps may not be available to all clients or in all jurisdictions. These apps are available via iPhone and iPad only and are provided free of charge to clients of UBS. The information you include in these app are for your personal use only. UBS will use your responses to personalize your digital experience, but will not update client records unless you confirm the information with your Financial Advisor. UBS account statements are the only official record of your UBS accounts. Information about external accounts you set up in My Total Picture is provided for your convenience and information only. UBS does not verify or reconcile the holdings, valuations or other information we receive about your external accounts or provide valuations of the assets or liabilities held in your external accounts. UBS Financial Services Inc.'s SIPC coverage and supplemental SIPC insurance only apply to eligible assets held by UBS Financial Services Inc. Unless we agree in writing otherwise, UBS does not provide advice or recommendations with respect to your external accounts and is not responsible for activity or transactions you conduct in your external accounts. UBS Financial Services Inc. is not a bank, and its securities accounts provide Legal InformationProducts and services mentioned on these web pages may not be available for residents of certain nations. Please consult the sales restrictions relating to the service in question for further information. UBS 1998 - 2025. All rights reserved.Bonnie Woo-Chan: CEO at Icicle Group & Co-Founder of Studio SV, Vice-Chair of HK Design Centre. In lieu of payment, a donation was made to Bonnie Chan-Woo’s charity of choice. The featured person/business is not implying sponsorship or endorsement of UBS or its products and services. Icicle Group, Studio SV and HK Design Centre are not affiliated with UBS Financial Services Inc.Michael Spence: Nobel Laureate in Economic Sciences. In lieu of payment, a donation was made to Michael Spence’s charity of choice. The featured person is not implying sponsorship or endorsement of UBS or its products and services.Simon Kidston: Classic car collector and broker. In lieu of payment, a donation was made to Simon Kidston’s charity of choice. The featured person is not implying sponsorship or endorsement of UBS or its products and services.Wealth management services in the United States are provided by UBS Financial Services Inc., a registered broker-dealer offering securities, trading, brokerage and related products and services. Member SIPC. Member FINRA.Notice for Non-U.S. Investors. Order Routing Disclosure. Statement of Financial Condition. Statement of Financial Condition- UBS FSI of Puerto Rico. Best Execution Statement. Loan Disclosure Statement. Account Sweep Yields. Advisory & Brokerage Services. CFP Board's Trademark Disclaimer. Important Information About Auction Rate Securities.Accolades are independently determined and awarded by their respective publications. Accolades can be based on a variety of criteria including assets under management, revenue, compliance record, length of service, client satisfaction, type of clientele and more. Neither UBS Financial Services Inc. nor its employees pay a fee in exchange for these ratings. Past performance is no guarantee of future results. For more information on a particular rating, please visit ubs.com/us/en/designation-disclosures.UBS Client Account Software Screnshots

Skip Navigation How It Works Pricing Education Community Support Member Dashboard Log In Log Out Start Plan How It Works Pricing Education Credit Education Credit Scores What is a FICO Score? FICO Scores versions How scores are calculated Payment history Amount of debt Length of credit history Credit mix New credit Improve my score Credit Reports What's in your report Bureaus Inquiries Errors on your report? Calculators Know Your Rights Identity Theft FAQ Glossary Community Support Member Dashboard Log In Log Out Get your FICO Score for free No credit card required Member 07-30-2024 08:16 PM Proper way to open a UBS Infinite credit card What is the best way to go about opening a UBS infinite credit card?My understanding is that if one wishes to open a UBS infinite card they must either have a UBS RMA account or have an active account with a UBS wealth advisor. I called their office number in Weehawken and tried to apply for an RMA account first. I got asked for my SSN + statements proving my holdings only to have the financial advisor to tell me that their team thinks I'm not a good match. For background context - I am a software engineer with more than 150K in comp this year (with upward trajectory) and around 1m in net worth. My FICO score is in low/mid 800's and have around 15 CC's opened in the past 5-6 years. I'd prefer to oepn an RMA account instead of creating a wealth advisor fund (their fees @ 1mil is 1.2%)Am I just wasting my time? Is there a "magic word" to say to open an RMA account? My employer uses Fidelity so I can't open an RMA through an employer either. Thanks in advance. All forum topics Previous Topic Next Topic Previous. UBS Software System : UBS Software: Contact : About Us : Support : Download : UBS Accounting : UBS Inventory : UBS POS : UBS Payroll : UBS Client Account : UBS Building UBS Client Account : UBS Building System : UBS Time Attendance : UBS One Accounting : UBS One Billing : UBS One Payroll : Download: 1. UBS Software Download :- UBS Accounting: 9.1UBS Software - UBS Client Account - Own-Free-Website.com

On a business day, your funds will be credited on the same day, and you will begin accruing interest that day. If your deposit is submitted after 12 p.m. ET on a business day or on a non-business day, your funds will be credited on the next business day. For any deposits from an external account, your funds will be credited in UBS Core Savings typically in one business day if you submit your funds transfer request before 6 p.m. ET on a business day. If your request is submitted after 6 p.m. ET on a business day or on a non-business day, your funds will be credited on the second business day. 6 Only non-advisory accounts can execute online UBS Core Savings deposits and withdrawals.About UBS Bank USA products and services UBS Bank USA is a member of the Federal Deposit Insurance Corporation (FDIC). Please carefully review the UBS Bank USA Core Savings Disclosure Statement available at ubs.com/coresavingsdisclosure. UBS Bank USA Core Savings deposits are made through an account at UBS Financial Services Inc., an affiliate of UBS Bank USA. UBS Financial Services Inc., as your agent and custodian, will open a deposit account with UBS Bank USA. UBS Bank USA Core Savings is not available for certain financial institutions, advisory accounts and non-resident aliens. Please see the UBS Bank USA Core Savings Disclosure Statement for a full list of eligible accounts. Ask your Financial Advisor for more information. UBS Bank USA Core Savings is not intended for clients In discretionary programs. The advisor designs your portfolio and can use a broader range of possible investments and strategies.Non-Discretionary programs. The advisor cannot trade on your behalf and only gives you recommendations in non-discretionary programs. You decide whether to follow the recommendations.Separately managed accounts programs. UBS partners with an external investment/money manager to design the portfolio. They allow you to combine the expertise of another investment manager with your advisor from UBS Wealth Management.The minimum account size depends on the program. Most require between $5,000 to $25,000 to get started. More complex programs require larger balances. For example, PACE Multi only requires $5,000 but limits your portfolio to mutual funds. UBS Strategic Advisor requires $25,000 but allows a broader range of investments, including equities, fixed-income securities, options and alternative investments.Brokerage ServicesWhile opening your account, you could also open a UBS brokerage account to trade on your own. That way, you could build your portfolio by buying and selling investments. There is no minimum needed to open a UBS brokerage account. The UBS Wealth Management brokerage platform offers a wide variety of investments, including:StocksBondsMutual fundsExchange-traded fundsAnnuitiesOptionsStructured notesAlternative investmentsIf you use the brokerage platform, UBS will not supervise your portfolio or give investment recommendations unless you are also part of one of its advisory programs.CostsInvestment Advisory ServicesYou and your advisor will negotiate a fee when you enroll in a UBS Wealth Management program. UBS Wealth Management uses a wrap fee where one annual fee covers advice, investment trading commissions from UBS andDownload UBS Client Account Software 9.2.1

This report is not available to clients of UBS Financial Services Inc.Enter UBS registered email This report is not available to clients of UBS Financial Services Inc.Log in without a passwordorEnter your password Keep this device logged inIncorrect password?Check the email is the UBS registered emailCall your UBS sales representative to update your emailCreate a new password by selecting Set password UBS Neo will remember your login, opt-out here Log inYour account is now lockedAccount locked?Your account is locked as you have incorrectly entered your login details multiple timesTo unlock your account, please contact UBS Neo HelpA login code has been emailed to:Didn't receive your login code?It may take a few minutes to receive an emailPlease ensure you’ve entered the UBS registered emailPlease check your spam folderTo set up 2-Factor Authentication we need to send you a one-time login codeAlternatively you can select another method to receive your login code Save as preferred methodIf you have not registered a mobile number with your UBS salesperson, please call UBS Neo Help for a login code UBS Neo HelpYou need to update your passwordGuidanceYour secure access to UBS Neo needs refreshing every 6 monthsYou will be notified 2 weeks before this is requiredPlease follow the instructions to set a new passwordA login code has been emailed to:Didn't receive your login code?It may take a few minutes to receive an emailPlease ensure you’ve entered the UBS registered emailPlease check your spam folderIf you still haven't received login code email please call UBS Neo HelpIt must not be based on your username, telephone number, or publicly known information about yourself.It must contain at least:It cannot be commonly used passwordNew passwordConfirm passwordNot the sameDifficulty creating a new password?Passwords must contain between 8 and 64 charactersInclude as least one number, one uppercase and one lowercase letterCannot contain three repeating charactersCannot be the same as your usernameCannot be a common password e.g. QWERTY01Special characters are optionalPlease contact UBS Neo HelpHaving difficulty creating personal questions?Please contact UBS Neo HelpMore information required?If you would like to discuss any of these Agreements, please contact your UBS sales representativeIf you would like to discuss any of these Agreements, please contact UBS Neo HelpGuidanceThis will keep you logged in on return to UBS NeoThe best practice is to not do this if you logged in to a public or shared deviceDownload UBS Client Account Software Free

The account administrative costs.UBS Wealth Management charges an annual asset under management fee based on your portfolio size, the advisory program and the complexity of your investment strategy. The maximum fee is 2.5% per year for most programs. What you will pay depends on what you negotiate with your advisor.If you work with an additional advisor outside of UBS Wealth Management for a separately managed accounts fee, they will also charge an annual fee. You’ll negotiate a combined yearly fee with UBS and the outside advisor.If you and your advisor choose to use investments outside of UBS that require additional investment fees, they will not be covered by the wrap fee. You’ll need to pay those on top of the annual UBS fee.Brokerage ServicesIf you trade on your own with UBS Wealth Management, you will owe commissions. The commission depends on the asset and size of the trade. UBS Wealth Management does not offer zero-commission trades like the top online brokerage platforms. You will also owe annual expense ratios for any mutual funds or ETFs you buy with UBS Wealth Management.UBS Wealth Management does not require a minimum balance to open a brokerage account. However, if your account falls below a minimum amount determined by UBS, you could owe a $95 annual maintenance fee.Financial PlanningYou can buy a standalone financial plan from a UBS Wealth Management Advisor, which you then manage on your own. UBS Wealth Management estimates it costs between $1,000 to $10,000 for most clients to get a. UBS Software System : UBS Software: Contact : About Us : Support : Download : UBS Accounting : UBS Inventory : UBS POS : UBS Payroll : UBS Client Account : UBS BuildingUBS Client's Account System - Software Informer

Who need to have frequent access to their funds. For non-advisory accounts, UBS Financial Services Inc. will charge you a fee of $25 for each withdrawal that you make from UBS Bank USA Core Savings in excess of five (5) withdrawals in a calendar month. For advisory accounts, if you make more than five (5) withdrawals in any calendar month, your entire UBS Bank USA Core Savings position (principal plus accrued interest) will be liquidated at the sixth (6th) withdrawal and deposited in your advisory account. Your funds will not be automatically re-deposited into UBS Bank USA Core Savings the following month. If you would like to deposit into UBS Bank USA Core Savings again, you may instruct your Financial Advisor to transfer funds back into UBS Bank USA Core Savings. For these purposes, a withdrawal will be considered to occur on the day on which the funds are actually withdrawn from UBS Bank USA Core Savings, which may not be the same day on which you place an order for the withdrawal with your Financial Advisor. Any applicable fees will be posted to your account at UBS Financial Services Inc. the business day following the excess withdrawal, and may reduce your earnings. You may incur a withdrawal fee or your position may be liquidated, as applicable, even if the withdrawal is involuntary such as if a withdrawal is made by UBS Financial Services Inc. to meet a margin call. Excluding promotional offers, UBS Bank USA Core Savings has aComments

Do not reflect actual investment results, and are not guarantees of future results. Use of the UBS Wealth Management USA app and UBS Financial Services app are subject to terms and conditions. Other restrictions may also apply. Certain products, functionalities and services described herein or contained or otherwise made available via these apps may not be available to all clients or in all jurisdictions. These apps are available via iPhone and iPad only and are provided free of charge to clients of UBS. The information you include in these app are for your personal use only. UBS will use your responses to personalize your digital experience, but will not update client records unless you confirm the information with your Financial Advisor. UBS account statements are the only official record of your UBS accounts. Information about external accounts you set up in My Total Picture is provided for your convenience and information only. UBS does not verify or reconcile the holdings, valuations or other information we receive about your external accounts or provide valuations of the assets or liabilities held in your external accounts. UBS Financial Services Inc.'s SIPC coverage and supplemental SIPC insurance only apply to eligible assets held by UBS Financial Services Inc. Unless we agree in writing otherwise, UBS does not provide advice or recommendations with respect to your external accounts and is not responsible for activity or transactions you conduct in your external accounts. UBS Financial Services Inc. is not a bank, and its securities accounts provide

2025-04-14Legal InformationProducts and services mentioned on these web pages may not be available for residents of certain nations. Please consult the sales restrictions relating to the service in question for further information. UBS 1998 - 2025. All rights reserved.Bonnie Woo-Chan: CEO at Icicle Group & Co-Founder of Studio SV, Vice-Chair of HK Design Centre. In lieu of payment, a donation was made to Bonnie Chan-Woo’s charity of choice. The featured person/business is not implying sponsorship or endorsement of UBS or its products and services. Icicle Group, Studio SV and HK Design Centre are not affiliated with UBS Financial Services Inc.Michael Spence: Nobel Laureate in Economic Sciences. In lieu of payment, a donation was made to Michael Spence’s charity of choice. The featured person is not implying sponsorship or endorsement of UBS or its products and services.Simon Kidston: Classic car collector and broker. In lieu of payment, a donation was made to Simon Kidston’s charity of choice. The featured person is not implying sponsorship or endorsement of UBS or its products and services.Wealth management services in the United States are provided by UBS Financial Services Inc., a registered broker-dealer offering securities, trading, brokerage and related products and services. Member SIPC. Member FINRA.Notice for Non-U.S. Investors. Order Routing Disclosure. Statement of Financial Condition. Statement of Financial Condition- UBS FSI of Puerto Rico. Best Execution Statement. Loan Disclosure Statement. Account Sweep Yields. Advisory & Brokerage Services. CFP Board's Trademark Disclaimer. Important Information About Auction Rate Securities.Accolades are independently determined and awarded by their respective publications. Accolades can be based on a variety of criteria including assets under management, revenue, compliance record, length of service, client satisfaction, type of clientele and more. Neither UBS Financial Services Inc. nor its employees pay a fee in exchange for these ratings. Past performance is no guarantee of future results. For more information on a particular rating, please visit ubs.com/us/en/designation-disclosures.

2025-03-25Skip Navigation How It Works Pricing Education Community Support Member Dashboard Log In Log Out Start Plan How It Works Pricing Education Credit Education Credit Scores What is a FICO Score? FICO Scores versions How scores are calculated Payment history Amount of debt Length of credit history Credit mix New credit Improve my score Credit Reports What's in your report Bureaus Inquiries Errors on your report? Calculators Know Your Rights Identity Theft FAQ Glossary Community Support Member Dashboard Log In Log Out Get your FICO Score for free No credit card required Member 07-30-2024 08:16 PM Proper way to open a UBS Infinite credit card What is the best way to go about opening a UBS infinite credit card?My understanding is that if one wishes to open a UBS infinite card they must either have a UBS RMA account or have an active account with a UBS wealth advisor. I called their office number in Weehawken and tried to apply for an RMA account first. I got asked for my SSN + statements proving my holdings only to have the financial advisor to tell me that their team thinks I'm not a good match. For background context - I am a software engineer with more than 150K in comp this year (with upward trajectory) and around 1m in net worth. My FICO score is in low/mid 800's and have around 15 CC's opened in the past 5-6 years. I'd prefer to oepn an RMA account instead of creating a wealth advisor fund (their fees @ 1mil is 1.2%)Am I just wasting my time? Is there a "magic word" to say to open an RMA account? My employer uses Fidelity so I can't open an RMA through an employer either. Thanks in advance. All forum topics Previous Topic Next Topic Previous

2025-04-03